Discount rate and capitalization rate

Introduction

In the financial sector, asset valuation relies on methods that determine their present and future value. Two rates are at the core of these methods: the discount rate and the capitalization rate.

Although these terms are often mentioned as equivalent, they are based on distinct principles and must therefore be used in specific contexts.

Definition and Theoretical Foundations

The Discount Rate: A Temporal Concept

The discount rate is used to determine the present value of a future cash flow. It is based on the concept of the time value of money, which asserts that €1 today is worth more than €1 tomorrow (due to risk and alternative investment opportunities).

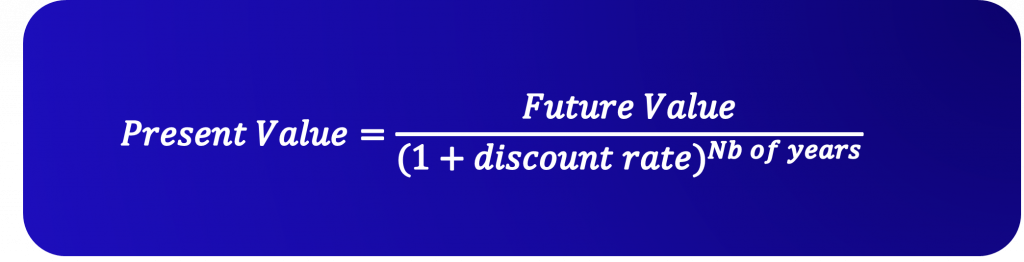

The formula for discounting is as follows:

The discount rate depends on several factors:

- The specific risk of the asset: the riskier an investment, the higher its discount rate

- The cost of capital: when valuing a company, the WACC (Weighted Average Cost of Capital) is often used to discount cash flows

- Inflation and interest rates: an increase in key interest rates can raise the discount rate required by investors

The Capitalization Rate: A Static Ratio

The capitalization rate is used to estimate the value of an asset based on the cash flows it generates. It is commonly found in real estate and well-established businesses with stable cash flow.

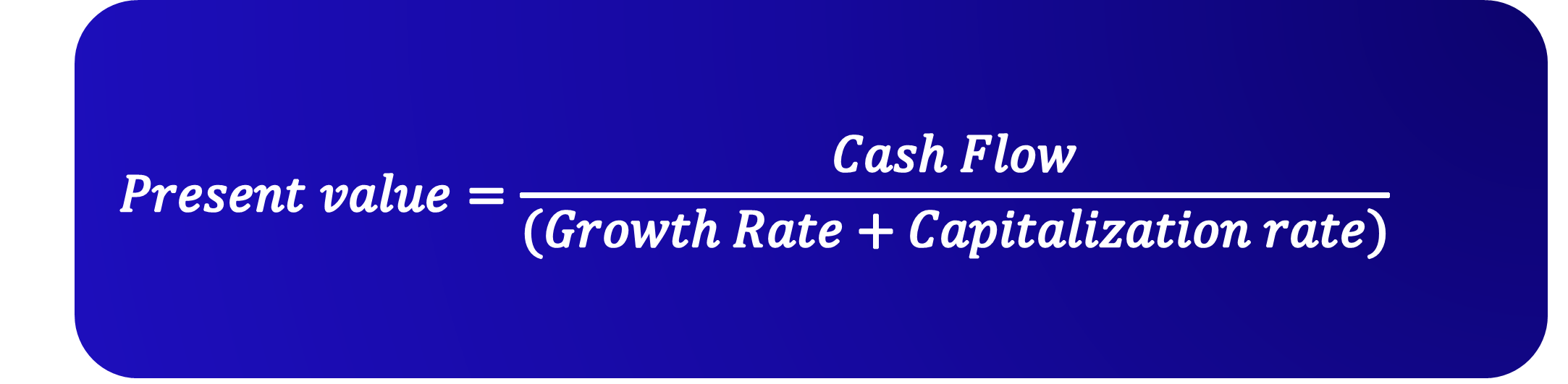

The basic formula is:

Conceptual and Methodological Differences

A Dynamic Approach vs. A Static Approach

- The discount rate takes into account the time value of money, whereas the capitalization rate is based on an anticipated return at a specific point in time.

- The discount rate is meant to be applied to anticipated cash flows, while the capitalization rate is designed to provide an immediate and direct estimate of an asset’s value.

A Different Sensitivity to Risk and Growth

The discount rate represents the time value of money as well as the general risk associated with a project. It is generally based on the cost of capital (WACC), meaning the expected return for investors on their invested capital. The degree of uncertainty has a significant impact on the calculation of this rate: the greater the risk, the higher the rate, thus reducing the present value of the cash flows.

The capitalization rate represents the return expected by investors and is based on the assumption of stable growth. It is primarily used to evaluate established assets producing constant profits.

The Link Between the Two Rates

The Capitalization Rate Can Be Derived from the Discount Rate

For a company with stable growth, the capitalization rate can be derived from the discount rate by subtracting the anticipated growth rate of future cash flows. This assumption holds that cash flows will grow sustainably at a stable rate, thus making it easier to calculate the capitalization rate.

Example: A company with a discount rate of 5% and a growth rate of 1% will have a capitalization rate of 4%.

When Should Each Be Used?

The discount rate is particularly suited for projects where the cash flows are uncertain or irregular. It accounts for the specific risk of the investment by adjusting the value of future cash flows based on the required return. It is, therefore, an essential tool for valuing companies with rapid growth, start-ups, or projects where profitability is delayed.

In contrast, the capitalization rate is more appropriate for assets with recurring and predictable cash flows. It is based on the assumption of long-term stability and provides an immediate value by dividing a sustainable income by a required return. This rate is frequently used in real estate, infrastructure, or businesses that have reached a mature stage with stable cash flows.

Practical Advice:

In practice, a financial analyst tends to merge these two methods into a DCF (Discounted Cash Flow) model. They use the discount rate to forecast and update future cash flows over a specific period, and then use a capitalization rate to estimate the final value of the asset or company beyond the forecasted period.

Conclusion

The discount rate and the capitalization rate are two fundamental instruments with very different uses. The former allows for updating one or more future cash flows, while the latter is used to evaluate assets perceived as mature with stable cash flows.

It is crucial to understand this difference to avoid the erroneous use of the rates discussed in this article.

- The discount rate provides the present value of future cash flows. It is a decision-making indicator for investment.

- The capitalization rate estimates the value of a financial asset at a specific point in time, in a phase of stable/mature cash flows.

It should be noted that the macroeconomic environment plays a major role in the evolution of these rates. A rise in interest rates can impact both the cost of capital and the expected return on investments, thus influencing all financial valuations.