Our Private Equity expertise

We implement solutions to support private equity and venture capital players

We provide technical and financial expertise to simplify portfolio management by developing custom-built tools, including:

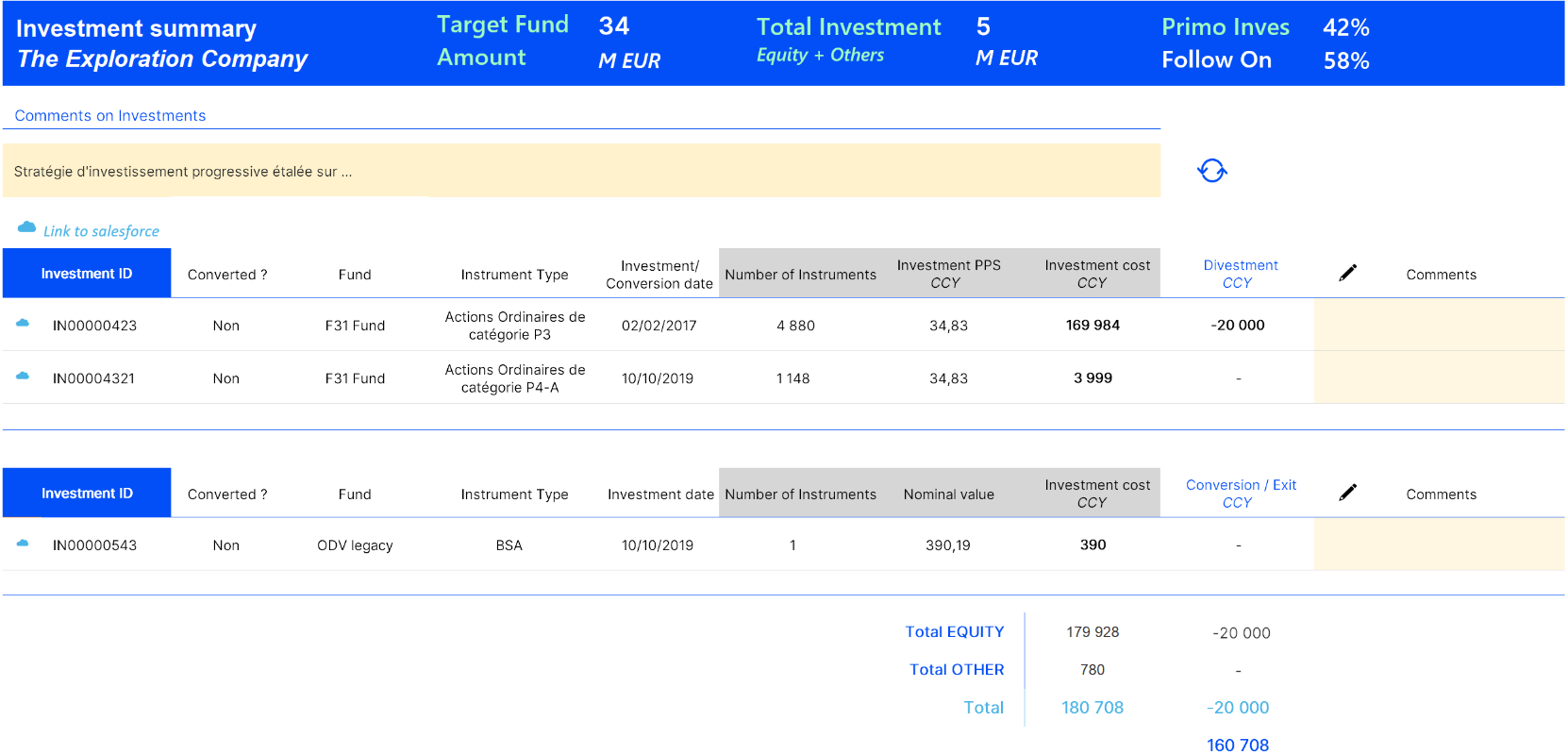

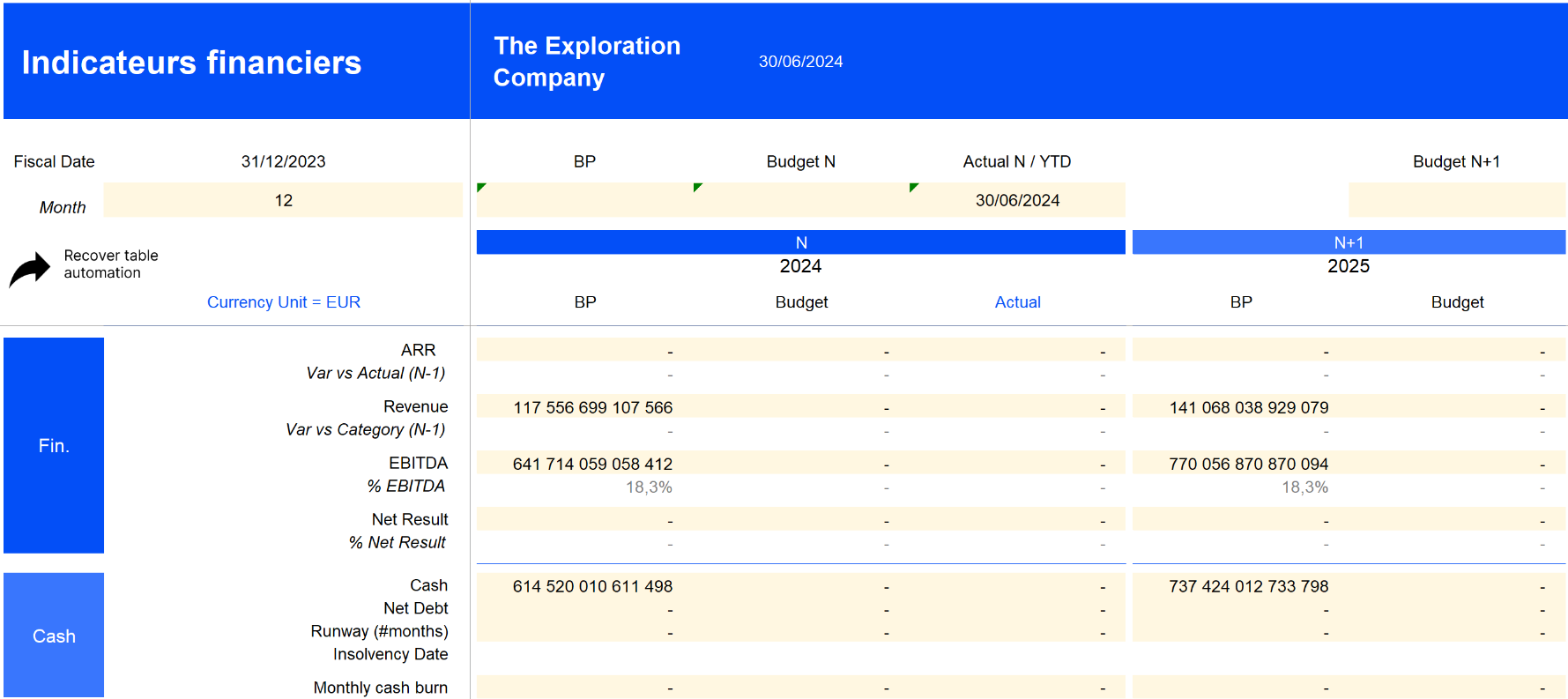

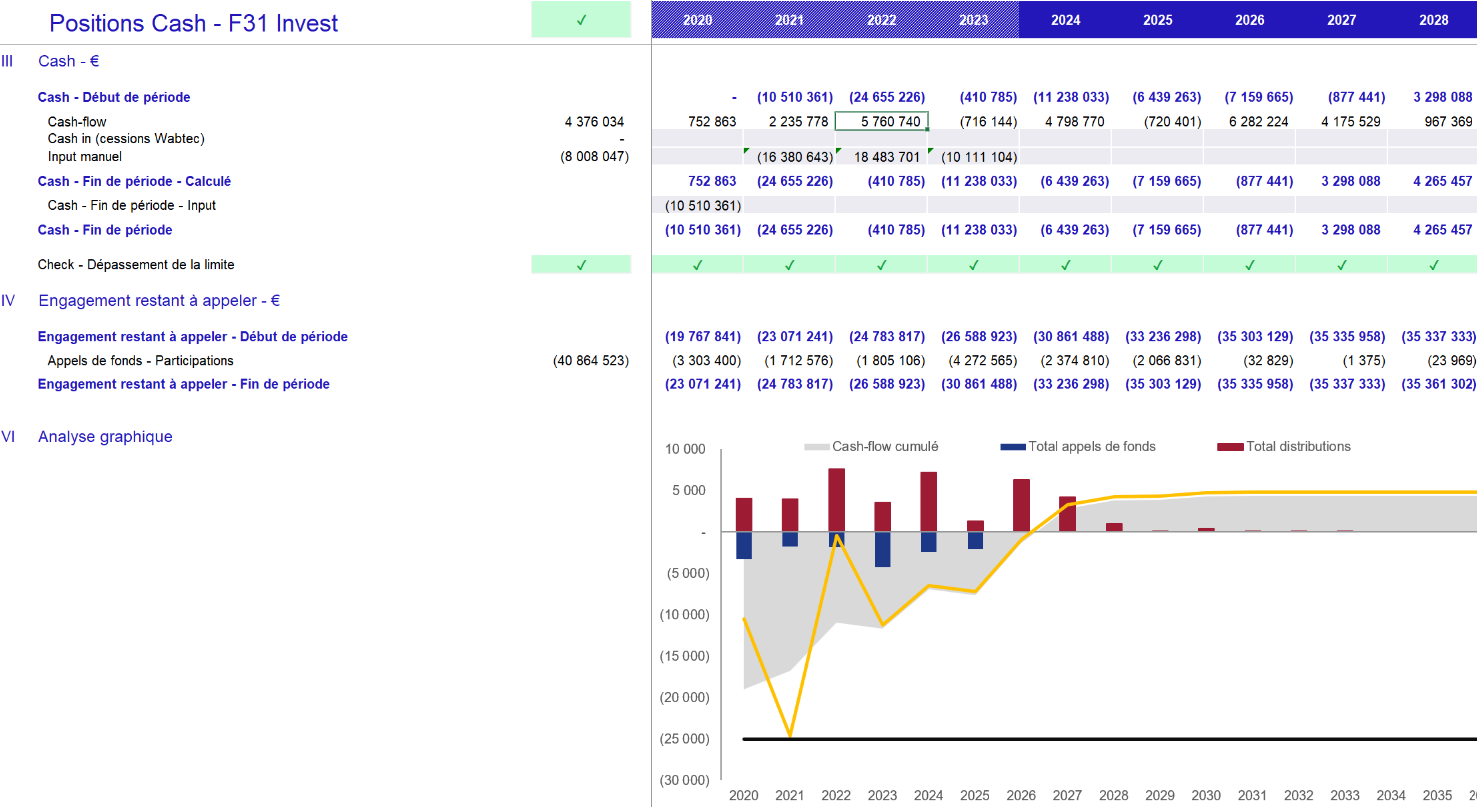

- Investment models to calculate indicators for the various assets in the portfolio (IRR, NAV, FMV, MOIC, etc.), manage the fund’s exposure and plan capital calls and future distributions.

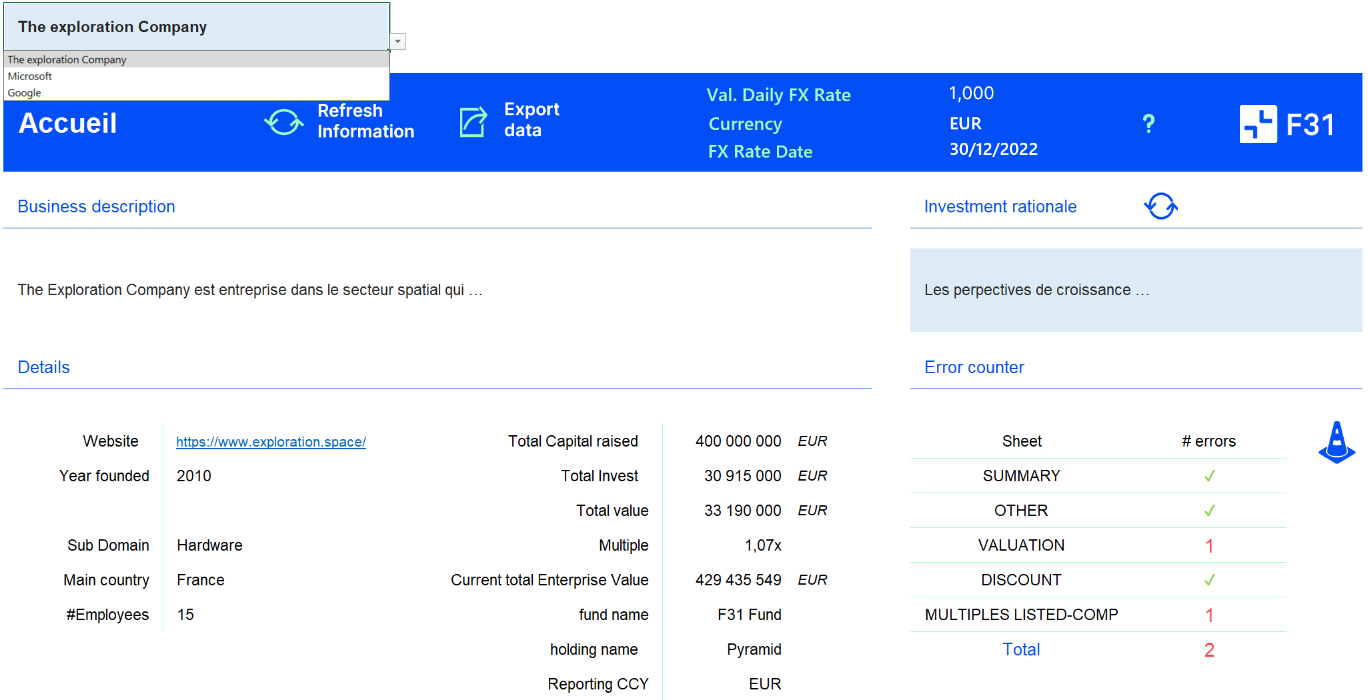

- Automated investment valuation tools from your CRM or ERP to speed up valuation exercises and ensure reliable data input.

- Interactive reports that provide a clear, up-to-date view of fund and investment performance, enabling you to communicate with investors and guide future decision-making.

Our solutions can be used to improve existing processes by addressing a range of issues:

- Improving reliability: our models enable you to consolidate different sources of information while controlling the quality of the data. We identify and highlight any inconsistencies in the input data to ensure the accuracy of the results obtained.

- Automation: thanks to the data flows put in place, models and reports will always be updated with the latest available data. Reports can be exported and sent automatically to the recipients of your choice.

- Historicization: our reports offer the option of historicising input data, enabling you to consult indicator values in the past. This enables a more in-depth analysis of the fund’s performance, for example by comparing projections with actual data.

- Reporting: we focus on the design of our tools so that they are ergonomic and intuitive. Our reports can replace the reporting process and be shared directly with investors.

Interactive investment monitoring report

An interactive Power BI report for monitoring your investment portfolio:

– Visualize performance across all levels of your portfolio.

– Track key indicators over time for deeper insights.

– Update data seamlessly through the integrated data entry interface powered by Power Apps, ensuring flexibility and real-time updates.

Automatically filled-in valuation forms

Our tools offer you the following functionalities: automated filling with data from past valuations (comments and values, as well as up-to-date CRM or ERP data, minimized manual input fields, consistency checks between valuation methods, automatic import of exchange rates to enhance reliability, seamless archiving of results using a data architecture compatible with Power BI.

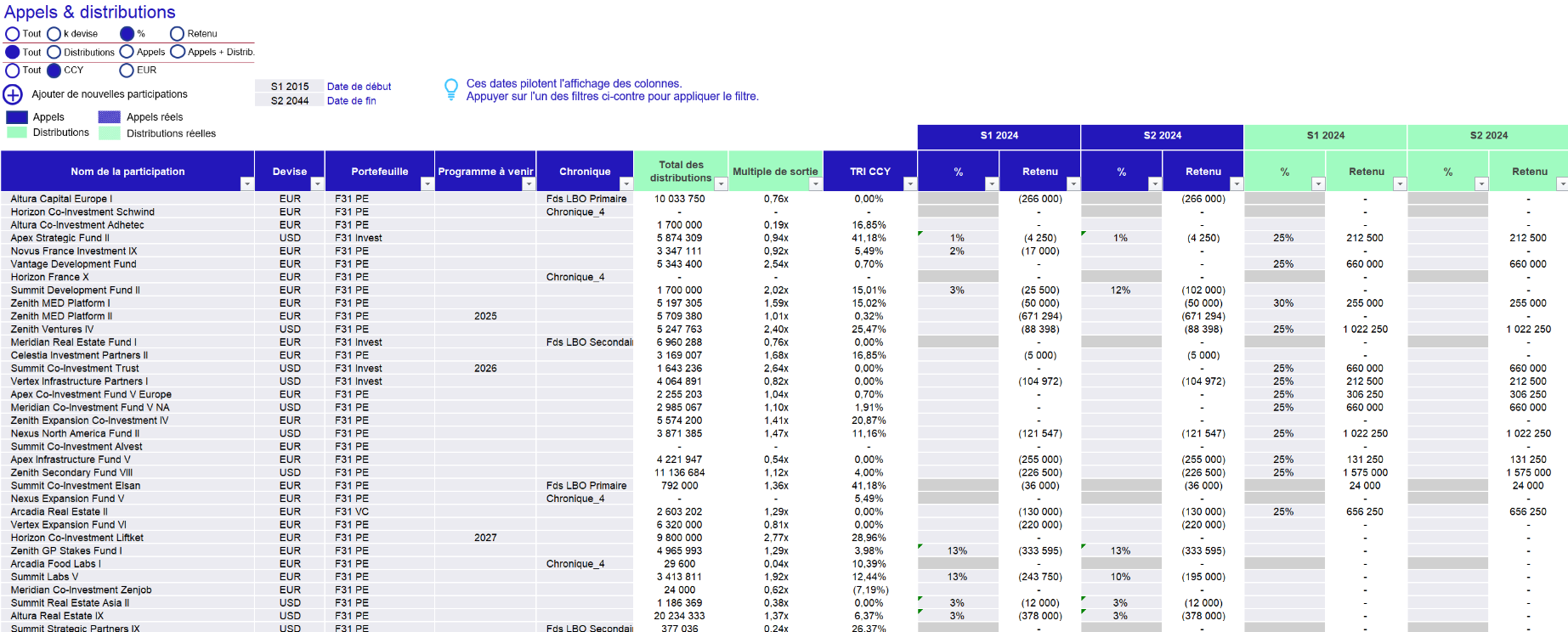

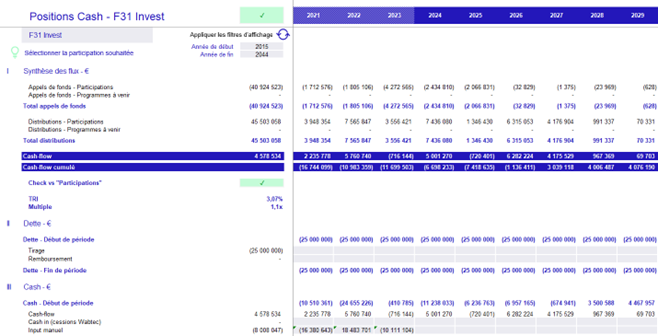

Call and distribution planning tool

Our tools feature the following functionalities: automated integration of actual data (through reprocessing of bank statements), definition of typical call and distribution chronologies, simulation of future programmes, fund/portfolio/equity breakdowns based on different scenarios, consistency checks between theoretical and actual data, navigation interface facilitating input entry.