Our expertise in Project finance

We work with French project finance companies.

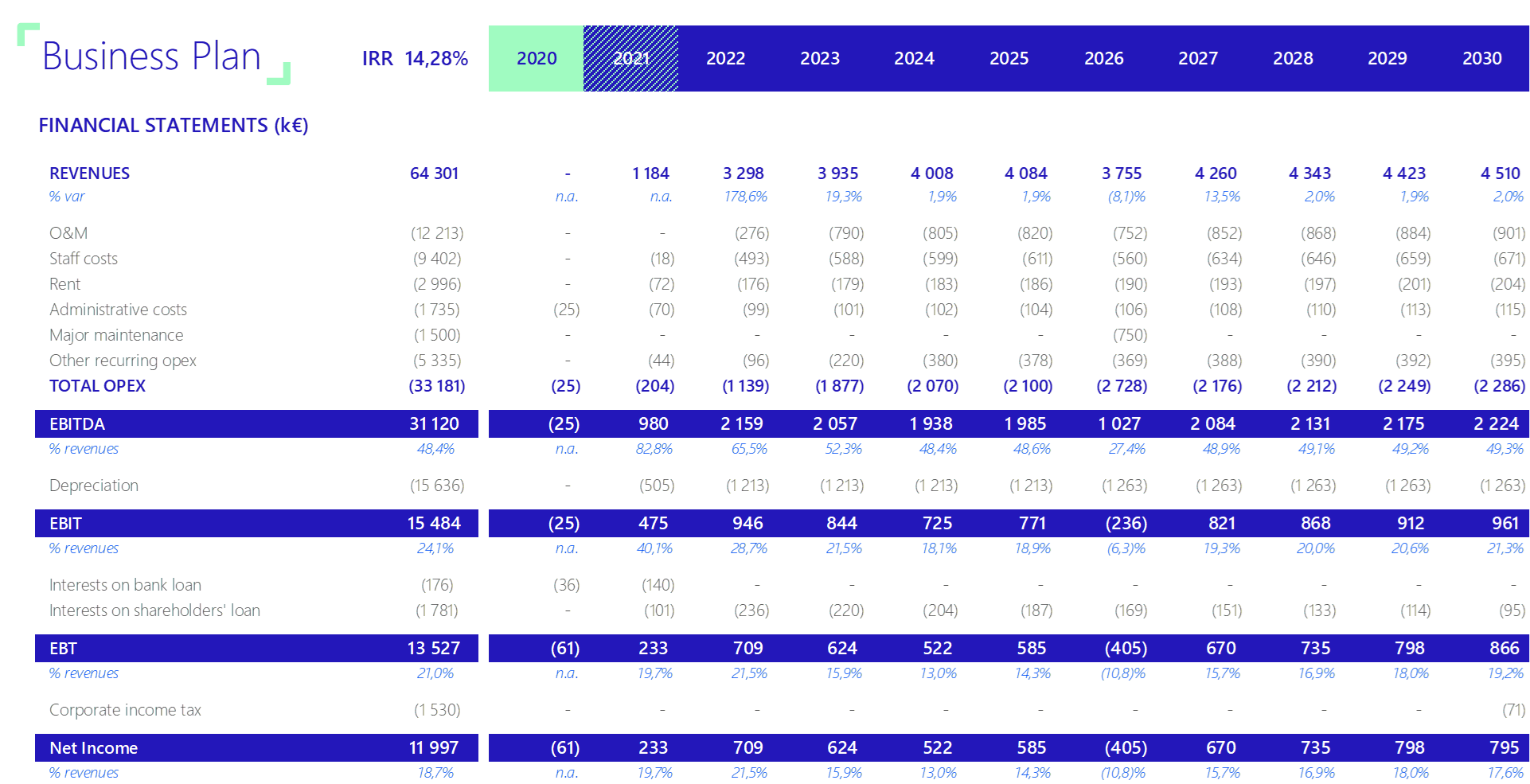

We develop easy-to-use customised models allowing them to calculate the profitability of their project while respecting the best standards for modelling:

- operational cash flows (production, tariffs, O&M contracts, Capex)

- debt sizing

- debt during the construction period (arrangement fees, capitalised interest, non-utilisation fee, revolving VAT)

- the different debt profiles during the operating period (constant P, constant P+i, target DSCR, sculpted, DSRA, DSCR and other ratios)

- possible refinancing during the project

- shareholder financing and distributions

- taxation

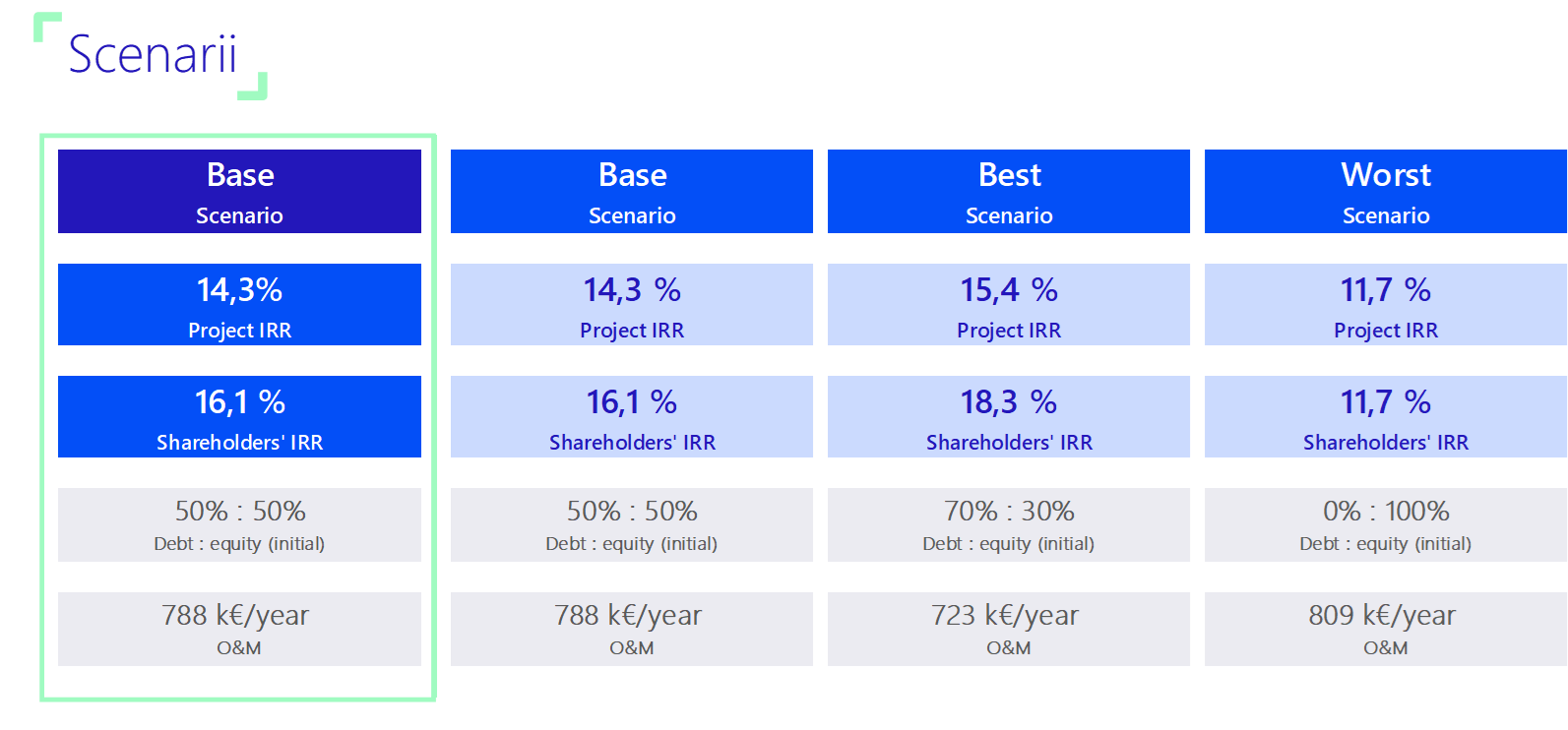

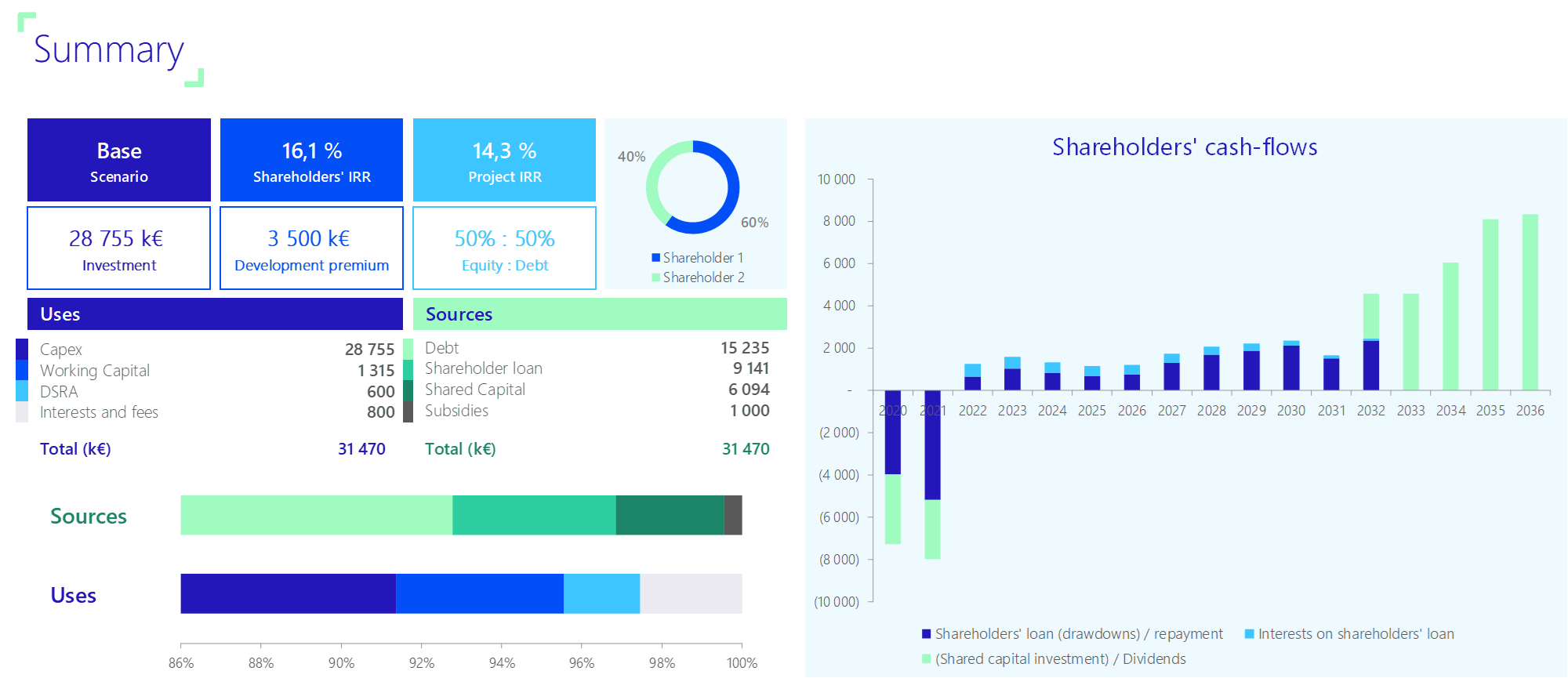

We provide a clear and user-friendly summary of the indicators needed to make an investment decision:

- project financial statements, cash flow to shareholders, Sources & Uses of Funds, IRR, NPV, etc.

- scenario simulations

- sensitivity analysis

In the case of a multi-asset purchase, we also model the shareholder structure (modelling of holding companies and possible tax consolidation).

Once the acquisition has been completed and the financing of the transaction has been structured, we continue to support our clients in monitoring their portfolio investments via:

- the transition from a project finance model to a management and monitoring model for the financed asset

- automated import process that adapts to your accounting files/software

- interactive reports with Power BI to visualise asset performance

Customised Excel models

The financing of your project, modelled in a reliable and accurate way.

Your project is complex: thanks to our dual financial and technical expertise, we model its financing in an easy-to-use model that helps you make the right decisions.

Interactive reports with Power BI

Your asset portfolio, shared with your team.

Using one or more Excel templates for each of your assets, your portfolio can be presented in a simple and user-friendly way.