Our expertise with treasury departments

For over 10 years, we have been working with the treasury departments of major French companies.

Thanks to our dual financial and technical expertise, our understanding of their business processes and their IT environment, we help them to:

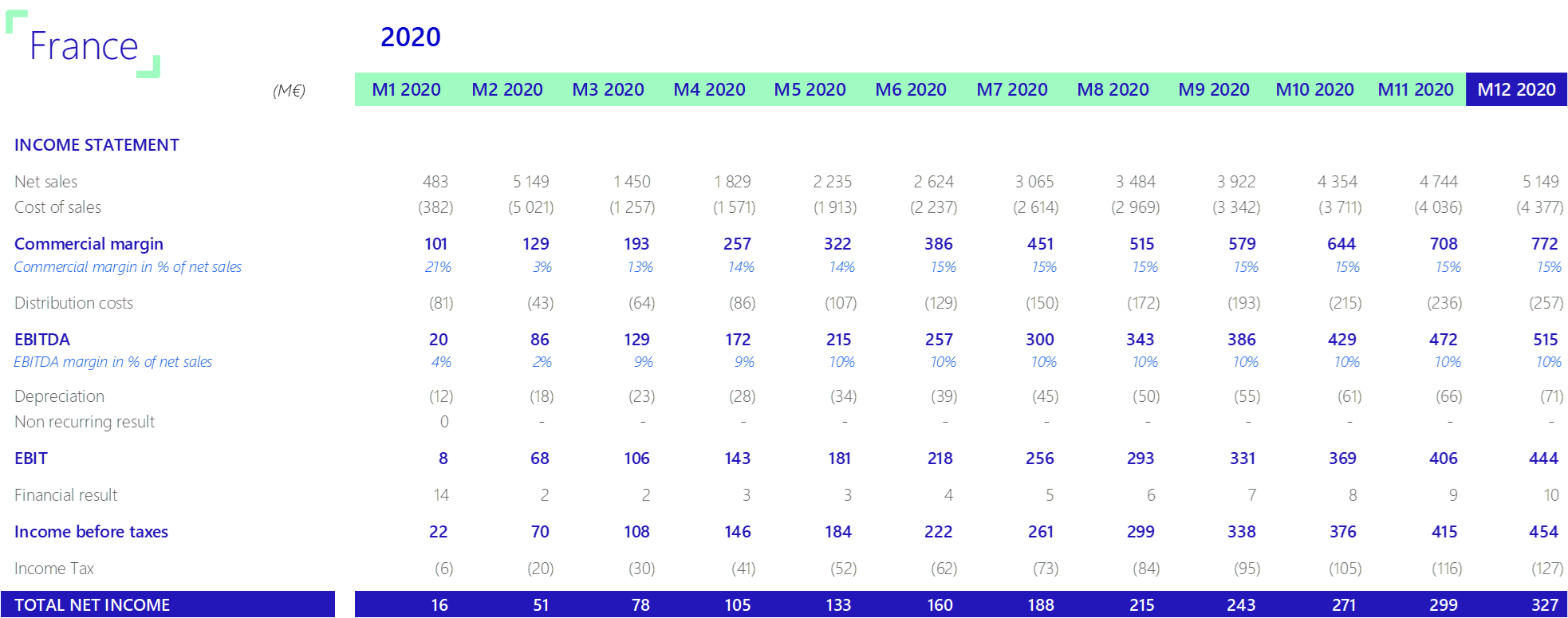

- make cash flow and net debt forecasts more reliable by designing models fed by manual input, extractions or direct queries on financial systems. Cash flows are modelled using the direct or indirect method (EBITDA-to-Cash).

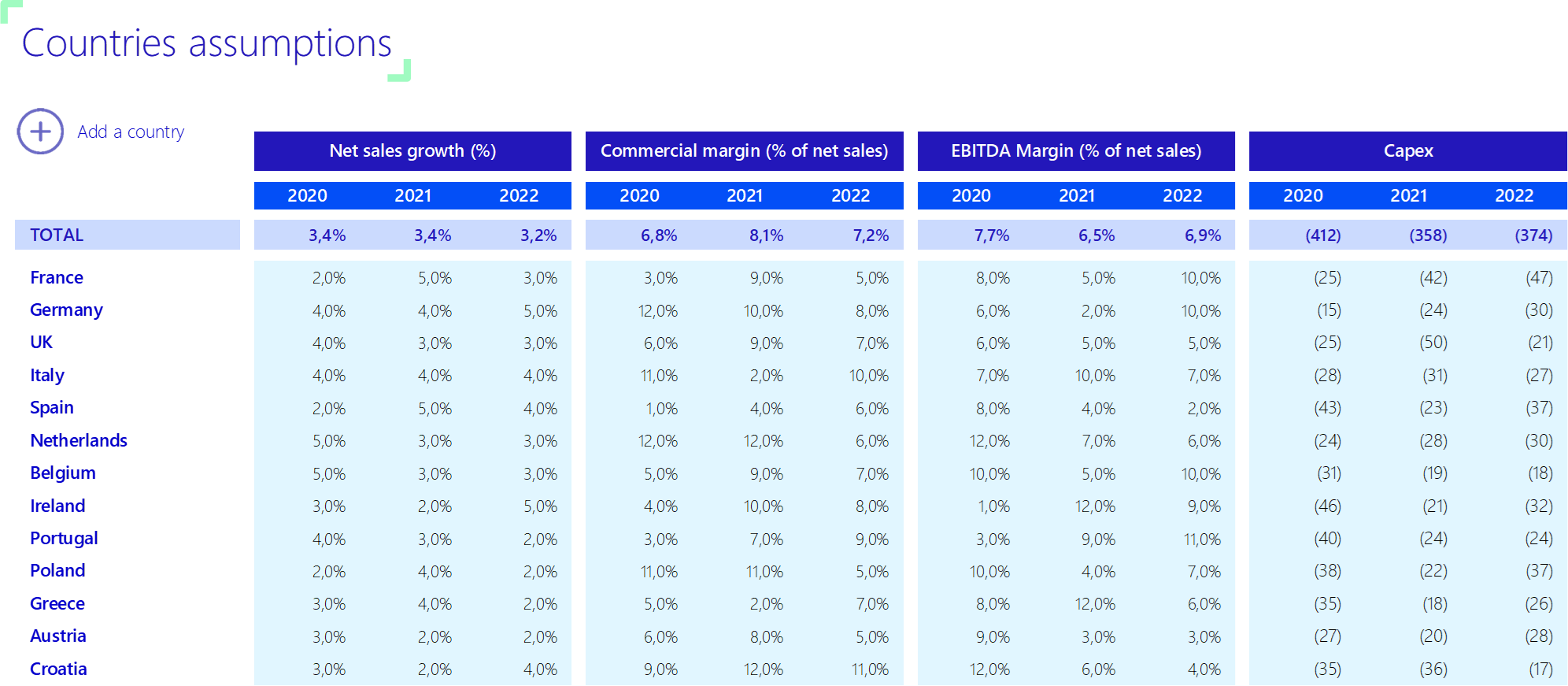

- simulate the evolution of cash flow and cost of debt according to different operational, investment or financial scenarios.

- automate the production of complex reports, such as hedging instruments or credit lines, with analyses to optimise the cost of financing.

We understand our clients’ issues and provide them with:

- tailor-made solutions, meeting their needs and developed in a few weeks.

- reliability, by automating their budget forecasting processes.

- vision, by allowing them to simulate different scenarios and their impact on cash flow, net debt, WCR, etc.

- ergonomics, with easy-to-use tools and powerful analysis.

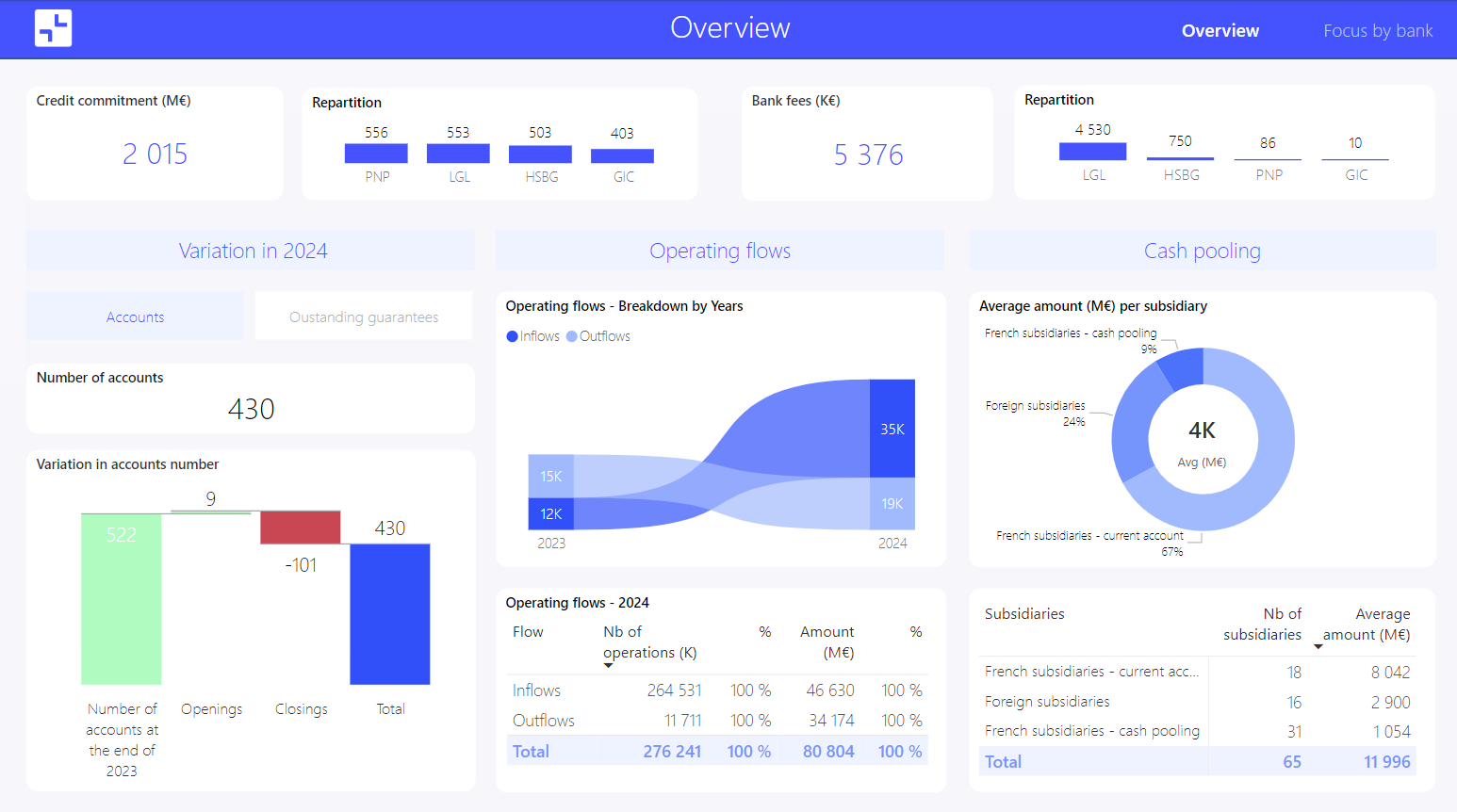

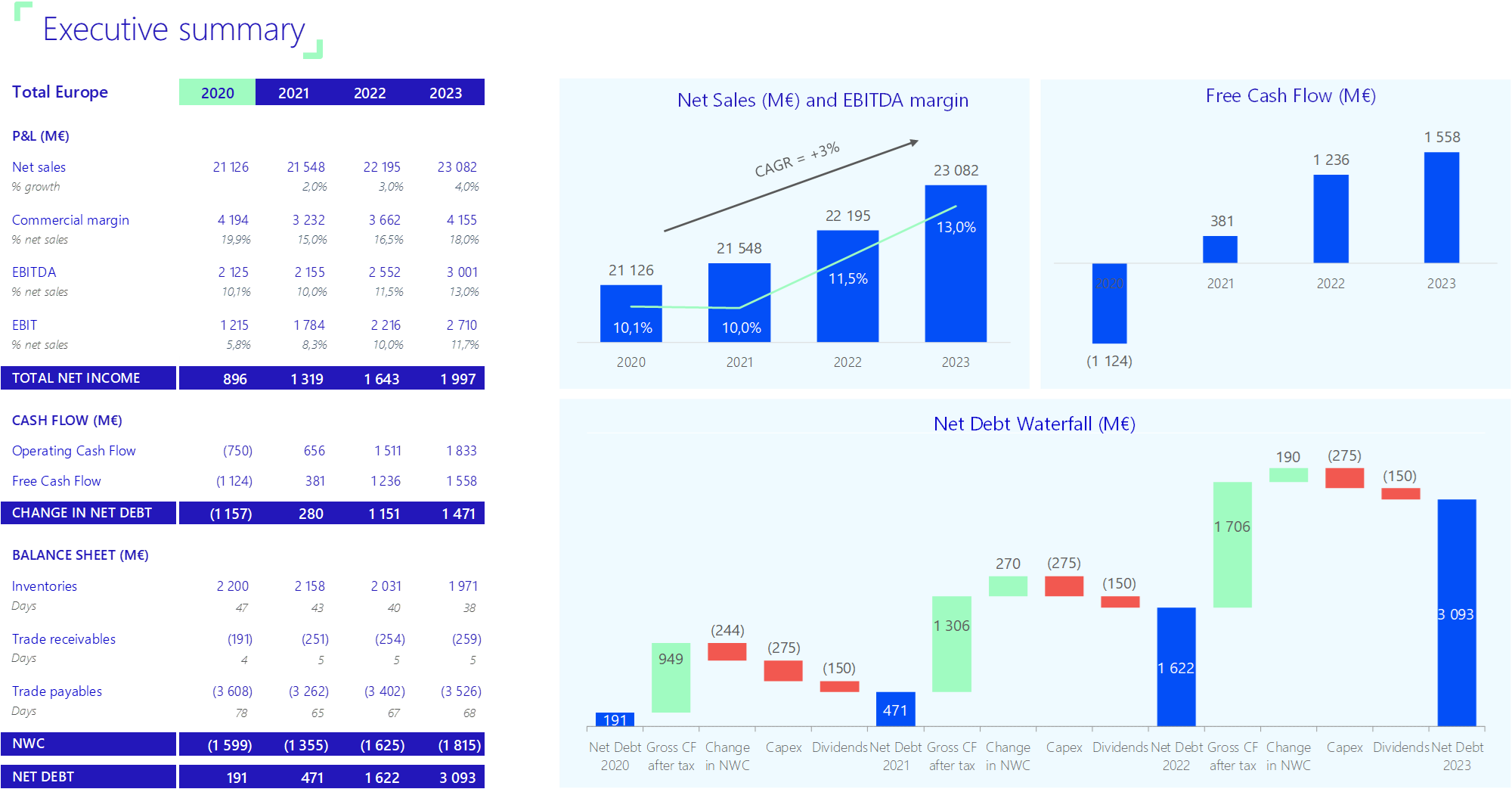

Interactive reports with Power BI

Easily view and analyse the figures that are essential to your treasury job, wherever you are.

Track cash and net debt, detail payments, and summarise banking relationships. Your data is up to date and clearly presented in a single dashboard. And you make the right decisions.

Customised Excel templates

Consolidation and reporting tools, short and medium-term cash flow forecasting models: we build a customised solution with you, adapted to your needs.

Interfaced with your information systems, these models provide you with clear reporting statements. They allow you to focus on analysis and decision-making.