Our expertise in Real estate

Experts in valuation and asset management financial models, we work for recognised leaders in the real estate sector.

Our solutions are aimed at real estate valuation experts, asset and property managers, as well as real estate investment funds and developers. With them, in a few weeks, we build tailor-made solutions:

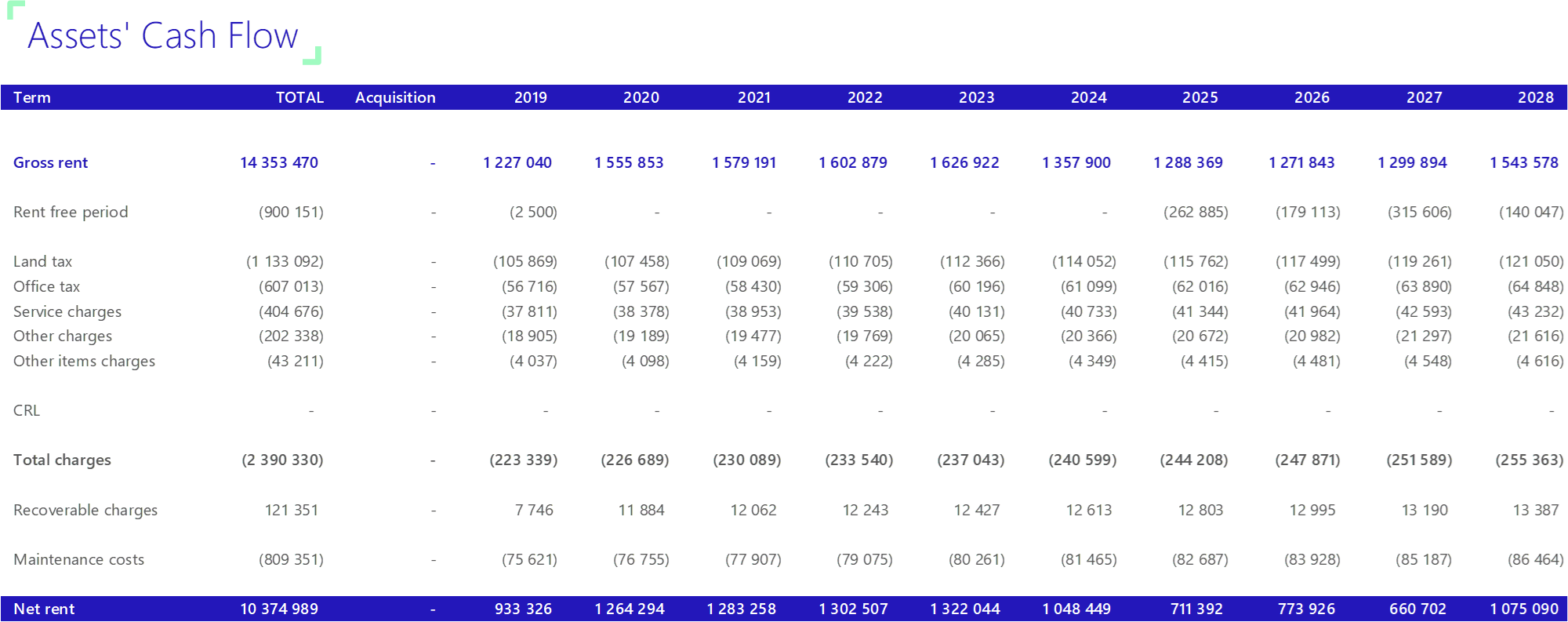

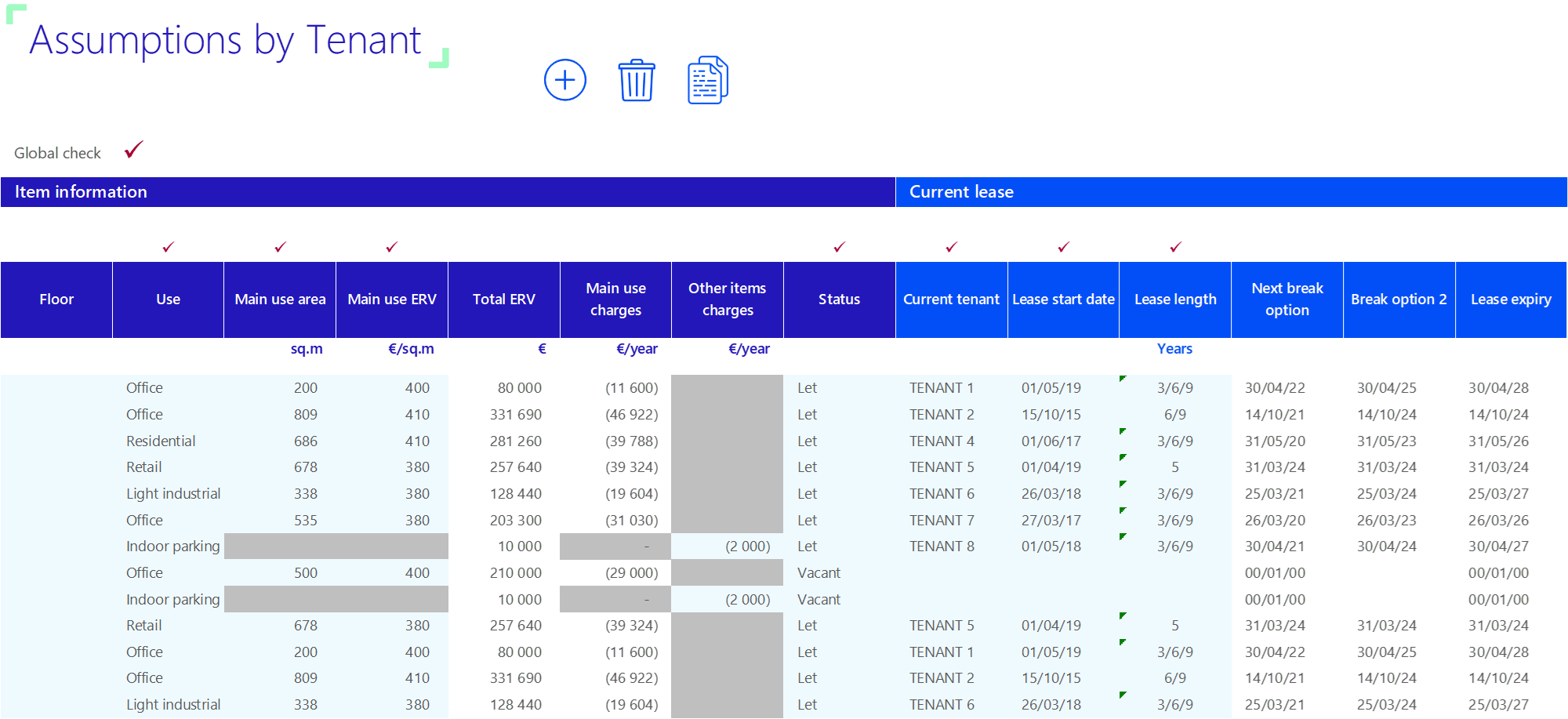

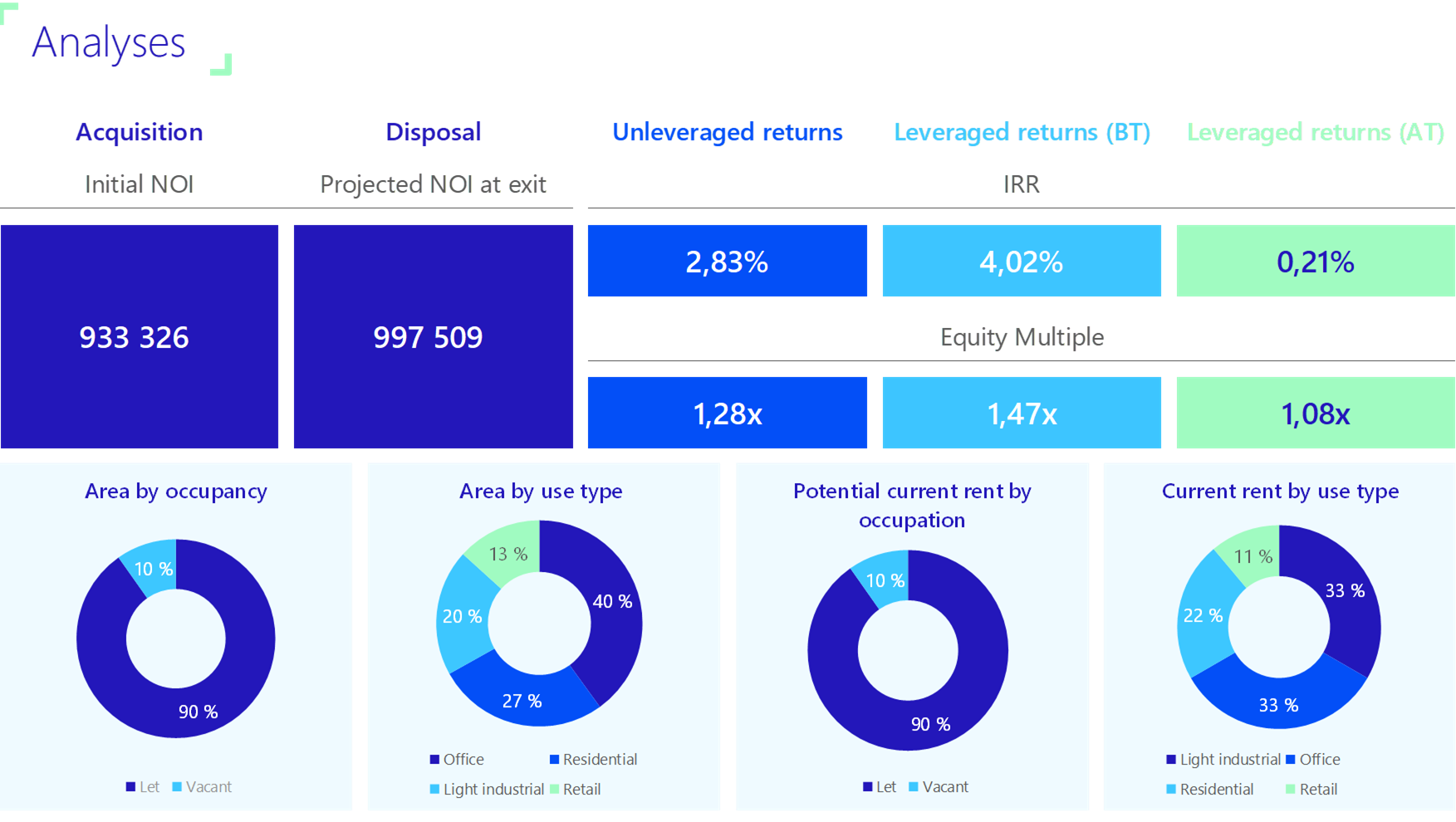

- Asset acquisition and management models that provide an accurate estimate of an asset’s return (IRR, cash on cash, equity multiple, etc.), assess its rental risk, and simulate different management scenarios (renewal, re-leasing, etc.) and investment strategies (off-plan property acquisition, value added, refurbishment, etc.)

- Valuation models enabling valuers to define the market value of an asset based on the three common methods (capitalisation, comparison and DCF) in order to establish a valuation report.

- Interactive reports offering a clear and impactful view of a property portfolio (monitoring and forecasting of vacancy, reversion and occupancy rates by geographical area, building, floor, etc.)

We understand our clients’ issues and allow them to:

- Save time in the daily operation of their business (e.g. automatic generation and consolidation of cash flows by unit from the rent roll).

- Be precise when entering assumptions (rent, tenant supporting measures), details of recoverable charges, TIs, capex, exit assumptions etc.

- Be flexible enough to integrate new parameters (purchase or sale of an asset, update of indexation rates, etc.)

- Visualize and interpret data easily, thanks to exceptional design.

Interactive reports with Power BI

Easily analyse the composition and profitability of your real estate portfolio.

Rental status, IRR, cash on cash, occupancy and reversion rates… Your data is up to date and clearly presented. And you make the right decisions.

Customised Excel templates

Asset acquisition, management and valuation models: we build a customised, flexible and scalable solution with you.

You save time and gain in accuracy in your analysis, for example to generate cash flows per lease or unit from a rent roll.